1123 Defining impound types

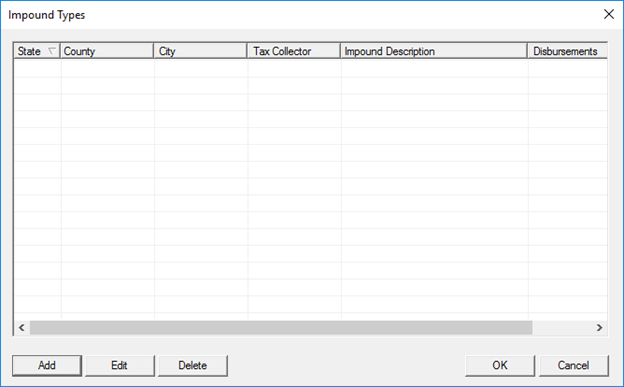

The Impound Types dialog box is used to populate the final tax and insurance impounds on the Banker > Fees & Impounds screen.

To create default impound type definitions:

1. Select Utilities > Company Defaults > Impound Types.

2. Click Add or select an existing impound type and click Edit.

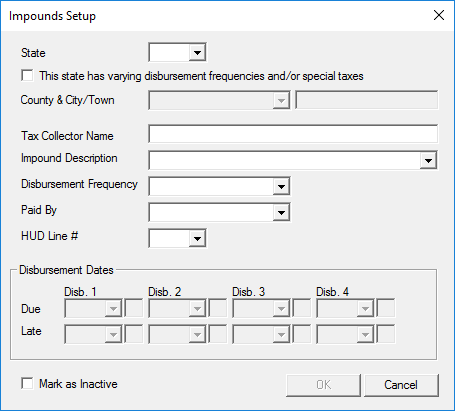

1. Select the State where the subject property is located.

2. Select the This state has varying disbursement frequencies and/or special taxes check box if it applies to the selected state.

3. Select the county from the dropdown list and enter the city.

4. Enter the Tax Collector Name and Impound Description.

5. Select the Disbursement Frequency.

6. Select the entity that is paying the disbursement from the Paid By dropdown list.

7. Select the HUD Line Number from the dropdown list or enter the line number manually.

8. Specify the disbursement dates.

-

- Select the month from the Disb. 1 dropdown list in the Due row that the first payment is due.

- Enter the day of the month that the payment is due in the field next to the month. The field becomes enabled when the month is selected.

- Select the month from the Disb. 1 dropdown list in the Late row to specify when the payment is considered late.

- Enter the day of the month that the payment is due in the field next to the month. The field becomes enabled when the month is selected.

- Continue the process for the subsequent disbursements for the disbursement frequency selected.

10. Click OK in the Impounds Setup dialog box to save the fee and return to the Impound Types dialog box.

11. Click OK again to close the Impound Types dialog box.