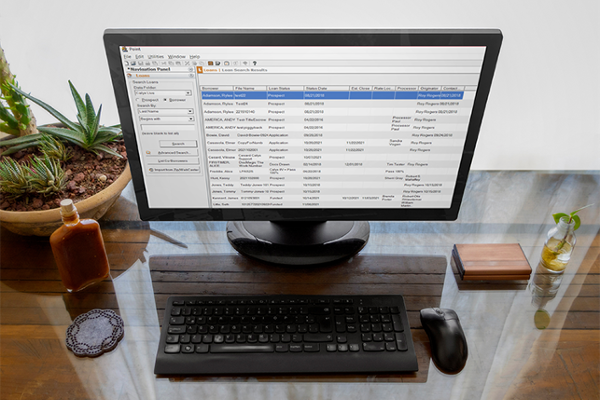

Point of Sale

Calyx offers a streamlined, customizable Point of Sale (POS) solution—known as ZIP—that is available exclusively as an add-on feature with your Point LOS subscription. Please note, it is not offered as a standalone product. Point POS (ZIP) is immediately accessible with every subscription, seamlessly enhancing your workflow and providing an exceptional interview and application experience for your borrowers.

Designed for simplicity and rapid deployment, this POS offers an affordable, efficient way to engage borrowers, whether they are applying on-site or remotely.

Additional ZIP Features:

- Personalized URL that can be added to your website, loan officer pages, or shared with borrowers for anytime, anywhere engagement.

- Simple Q&A interview process—no confusing forms.

- Cost: $3 per loan application—with no upfront fee or monthly minimum; charged only per use.

- eSign package: $1.50 per transaction.

Please note: This is an add-on feature available exclusively with your Point subscription.

Set Up

Need to cancel Point of Sale? Unsubscribe