-

Product Solutions

-

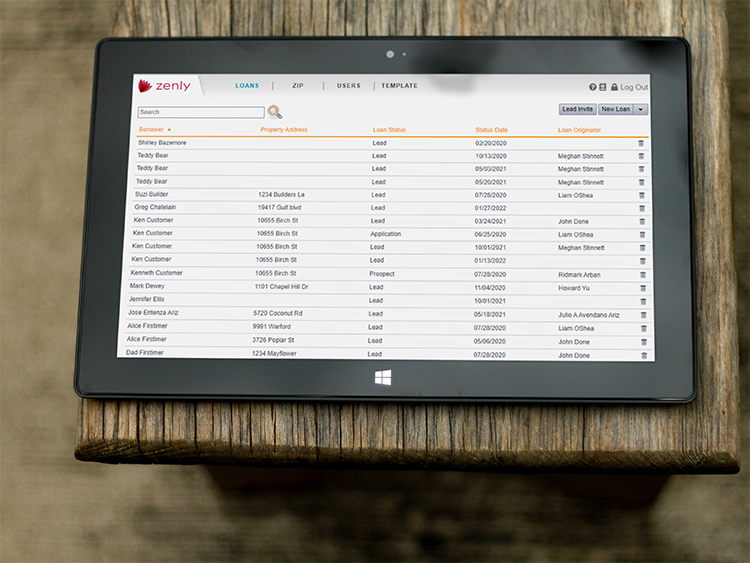

Find your LOS Solution

- Calyx Software has solutions for every size lender to enhance their origination business from lead gen through closing.

- Our solutions are built for mortgage professionals by mortgage professionals.

- Business Types Who We Serve

- Wholesale Marketplace

- Solutions for Small Lenders and Brokers

- Solutions for Banks and Financial Institutions

-

Find your LOS Solution

- About Us

- Integrated Vendors

- Resources