2013 Entering a Construction-to-Perm Loan with a Payoff

Complete the Loan Application and Fees Worksheet as you would for any other loan, with the following exceptions:

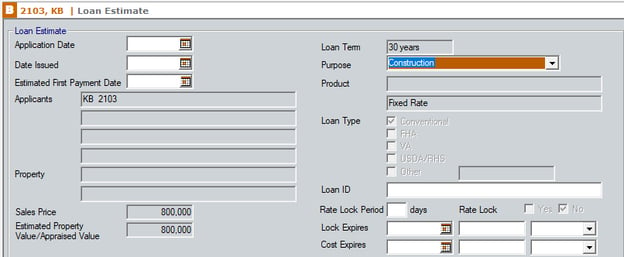

1. Navigate the Borrower Information screen.

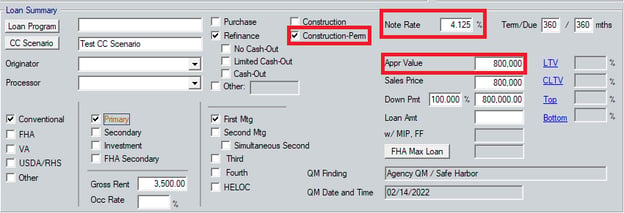

2. Select the check box to indicate the loan is a Construction-Perm.

3. Enter the Note Rate and Term/Due for the permanent financing.

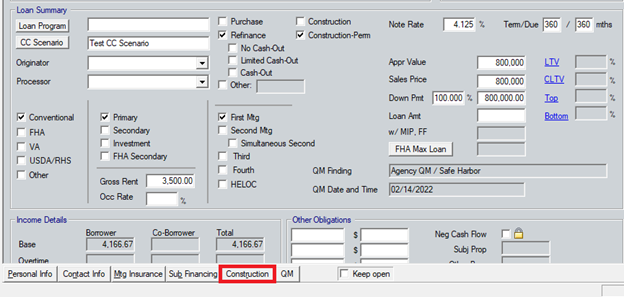

4. Enter the Appraised Value (after construction), and Loan Amount.

5. Click the Construction button at the bottom of the screen.

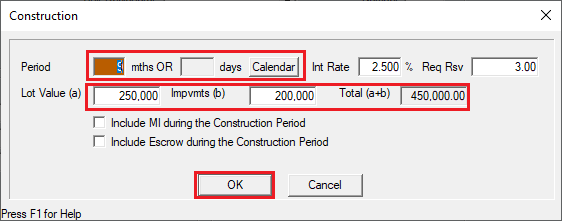

6. Enter the construction period (as a monthly value) in the Period field or click the Calendar button and enter the From and To dates. Point will calculate the number of days.

7. Enter the Int Rate of the construction period and required reserves (if applicable) in the Req Rsv field.

8. Indicate whether mortgage insurance or escrows are to be collected during the construction period by selecting the applicable check box.

9. Enter the Lot Value, and Improvements, as applicable. Point will automatically calculate these values and populate the Total (a+b) field.

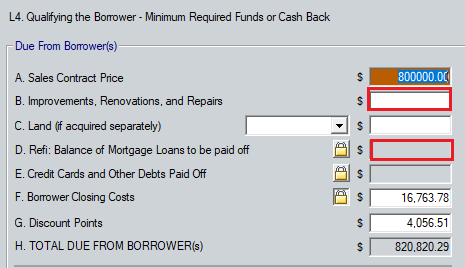

10. Navigate to Lender Loan Information – Page 2, section L4 Qualifying the Borrower – Minimum Required Funds or Cash Back.

11. Enter the Construction Cost in B. Improvement, Renovations, and Repairs and Payoff Amount in D. Refi. Balance of Mortgage Loans to be paid off.

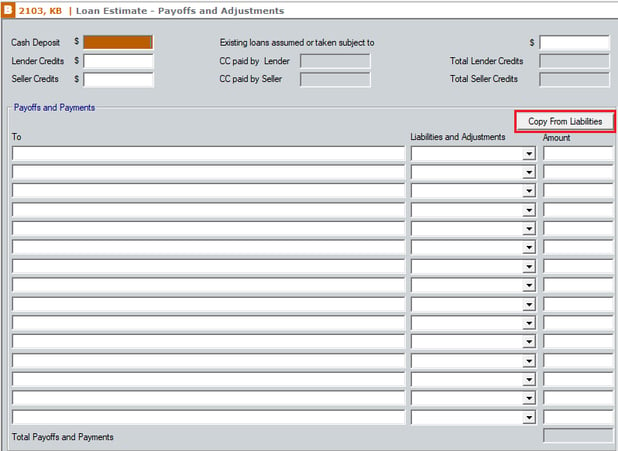

12. Navigate to the Loan Estimate or the Fees Worksheet. Locate the – Payoffs & Adjustments button at the bottom screen and click.

13. Enter the payoff amount of the existing lien or click the Copy From Liabilities button to populate the data from the Liabilities.

14. Enter the amount of the construction payout and chose Mortgage for the Liabilities and Adjustments dropdown.

15. Navigate to the Loan Estimate.

16. Select the loan Purpose from the dropdown menu.