2016 Completing Section 1 of the New URLA

Loan Application - Section 1

1. Open a loan file.

2. Navigate to Loan Application - Section 1 either from your left navigation panel or using the Forms menu in your top toolbar.

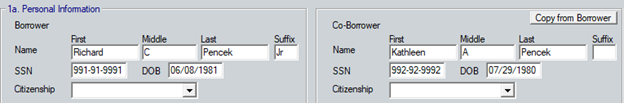

The borrower's personal information will populate from the same fields on the Borrower Information screen.

3. Use the Alternate Name table to add in any previous or also known as names.

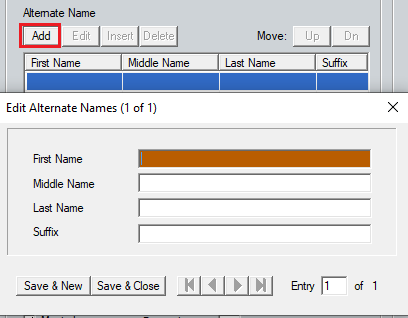

4. Use the available checkboxes in the Marital Status & Dependents section as appropriate for this file.

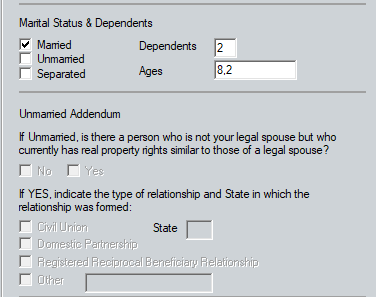

5. The Former Address table will allow you to list multiple current or previous addresses where applicable.

6. From the Preferred Language dropdown, select the preferred language indicator.

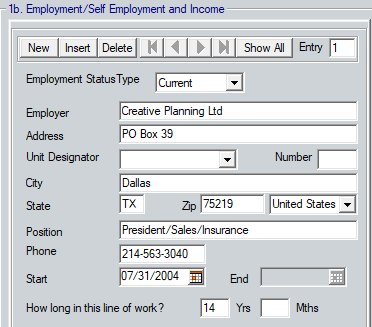

7. Complete the Employment/Self Employment and Income section.

a. Use the Employment Status Type dropdown to select the Current or Previous option.

b. Complete the current employer information.

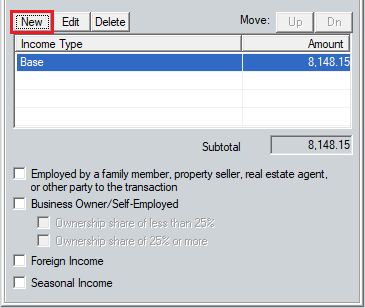

The Income Type table will now be available for data entry.

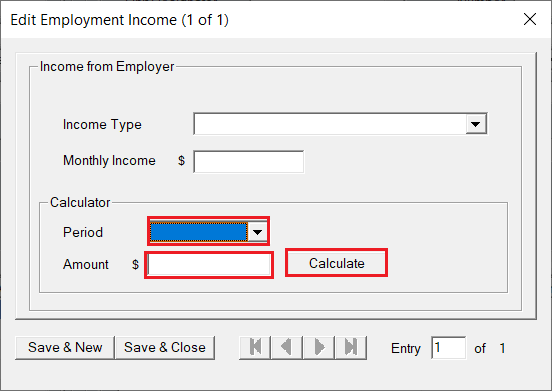

c. Click the New button above the Income Type table.

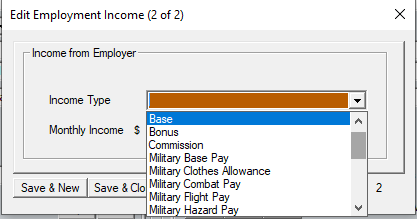

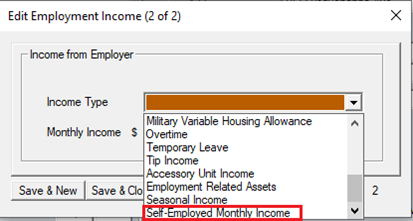

d. Select the Income Type from the dropdown.

Note: There is a Self-Employment Income option in this dropdown.

e. Enter the Monthly Income.

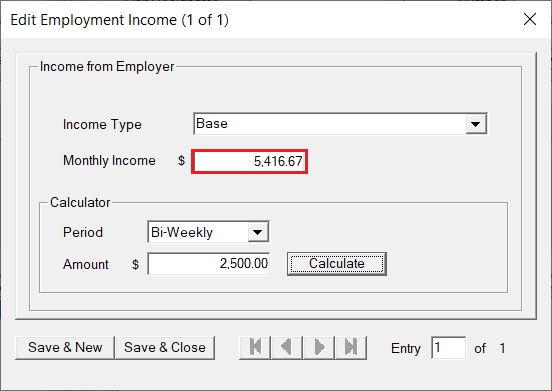

f. Alternatively, you can use the Calculator.

1. Use the Period dropdown to select how often the borrower is paid.

2. Enter the Amount per period.

3. Click the Calculate button.

4. The Monthly Income field will populate.

5. Click the Save & Close button if there is only one income type from this employer, otherwise select the Save & New button.

6. To add another current or previous employer, click the New button at the top of the section and repeat steps a through c.

7. Use the arrow buttons to cycle through the entered employment information or click the Show All button to view the List of Employers window.

8.Use the checkboxes at the bottom of the section for self-employment options.

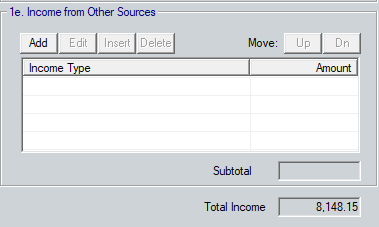

9.Complete the Income from Other Sources section when applicable.

Note: This table is for income that comes from sources outside of employment.

The Total Income field will only populate when the Employment Status Type dropdown is set to Current.