2208 Comparing Tolerance for the Loan Estimate and Closing Disclosure

2. Click the Copy from Fees Worksheet button to copy over current fees.

3. Click the Closing Disclosure button at the bottom of the screen to open the Closing Disclosure.

4. Locate and click the Tolerance button at the bottom on the screen.

5. The “Exceeds legal limit by” field will populate the cure for fees beyond the tolerance threshold.

The Tolerance section houses two comparison tables:

Fees that cannot change (Zero Tolerance)

This table will list the description of any fee(s) that have a zero tolerance, the current fee amount, the baseline the fee is being compared to, and any tolerance overage for each fee. The Total field at the bottom of the table will total all overages for this fee type.

Aggregate of fees that cannot change more than 10%

This table will list the description of any fee(s) that have a 10% tolerance, the current fee amount, the baseline the fee is being compared to, and any tolerance overage. The Total fields at the bottom of the table will total the overages for the current fees, their baseline, and the amount exceeding the 10% cap.

Tolerance Types Explained

Zero Tolerance Fees

Zero Tolerance means there is to be no fee amount increase between those disclosed on the Loan Estimate and the Closing Disclosure. Any increase would exceed the tolerance threshold.

Lenders are not permitted to charge more than amounts for fees disclosed on the Loan Estimate unless there is a change of circumstance that would trigger the need for a revised Loan Estimate. Fees that fall in this category are typically for services the lender has control over or access to the actual fee amounts. Due to this knowledge and access, lenders should be able to disclose very accurate information and not need a tolerance cushion.

Fees that fall under this category are:

- Those PaidTo the Lender, Mortgage Broker, or Affiliate of either.

- Fees paid to an unaffiliated third-party will also apply if the Lender did not permit the borrower to shop for a third-party service provider for any settlement service.

- Transfer Taxes

- Origination Fees

The Zero Tolerance fees are those in sections A. Origination Charges, B. Services You Cannot Shop For, and some of those in section C. Services you Can Shop For.

Aggregate of fees that cannot change more than 10%

Any of the fees that change between the Loan Estimate and the Closing Disclosure will list in this table, but are not looked at on an individual level – instead the tolerance is calculated by the total sum of the amount increases. There is only a need to cure if that total sum has increased by over 10%.

Fees that fall under this category are:

- Recording Fees

- Third-party services that are not paid to the Lender or Lender Affiliates

- Services the borrower is allowed to shop for

- If the borrower is allowed to shop for a service, but shops off the Written List of Service Providers, the item will change to the cannot shop section on the Closing Disclosure.

The 10% tolerance fees are those in sections B. Services You Cannot Shop For, C. Services You Can Shop For, and E. Taxes and Other Government Fees.

The fees in the Baseline column are listed in either table and are based on the fees from the Loan Estimate or the last saved fees from the Loan Estimate or Closing Disclosure once the baseline has been reset.

You can reset your baseline to match the current fees and recalculate tolerance, but, resetting baseline will overwrite the fees in the baseline column with the current fees from the Loan Estimate or Closing Disclosure.

Resetting your Baseline

1. Open the Closing Disclosure.2. Click the Tolerance button at the bottom of the screen.

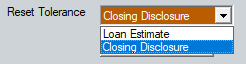

3. Select either the Loan Estimate or Closing Disclosure from the Reset Tolerance dropdown list.

4. Click the Reset Baseline button.

The Baseline link in the Tolerance section is now active so you can view the new baseline amount view and store the fees that were disclosed from the Loan Estimate or Closing Disclosure at the time the baseline was reset.

The fields next to the link will show which form the tolerance was reset on, along with the date and time.

![]()

Note: If the fee has been changed multiple times, but the baseline was not reset, the totals will be comparing the original amount to the most current fee amount changed in the file.