2307 Entering Lender-Paid Compensation to Broker

Lender-Paid Compensation to Broker does not print on the Loan Estimate but is disclosed on the Closing Disclosure. However, for accurate QM calculations, an entry is required on the Fees Worksheet.

Per CFPB 1026.37(f), commentary (2)

Indirect compensation from the lender to the originator is not disclosed on the Loan Estimate, but rather is disclosed on the Closing Disclosure. However, direct compensation to the loan originator from the borrower is disclosed on the Loan Estimate.

The Lender-Paid Compensation to Broker field on the Fees Worksheet is compensation to the broker for the borrower interest rate credit. Therefore, it is considered indirect lender compensation and is not disclosed on the Loan Estimate.

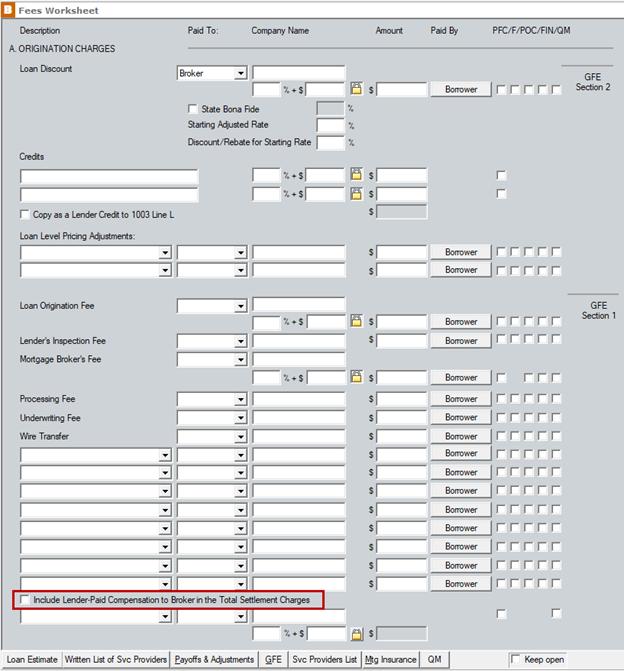

To enter lender-paid compensation to the broker on the Closing Disclosure:

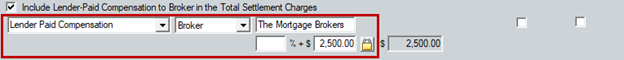

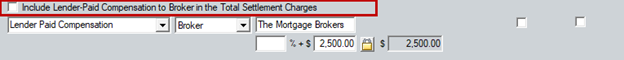

1. Go to Section A. Origination Charges on the Fees Worksheet.2. Select the Include Lender-Paid Compensation to Broker in the Total Settlement Charges check box.

3. Complete the following fields:

Fee Description

Paid To

Company Name

4. Enter the applicable percentage or dollar amount of the lender-paid compensation.

-

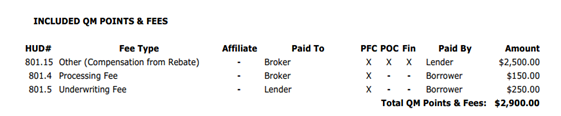

- Click the QM button to run the report.

QM page 2

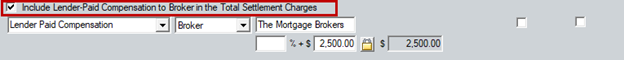

5. Click the Include Lender-Paid Compensation to Broker in the Total Settlement Charges check box before issuing the Loan Estimate to avoid including the amount in the Estimated Cash to Close.

Loan Estimate, page 2

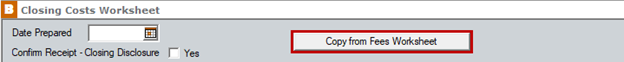

6. Open the Closing Costs Worksheet.

7. Click the Copy from Fees Worksheet button.

8. Select the Include Lender-Paid Compensation to Broker in the Total Settlement Charges check box.

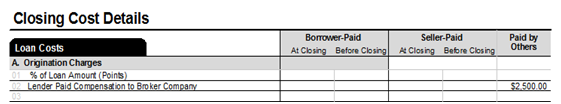

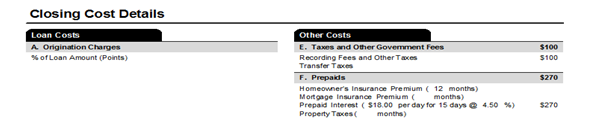

The fee amount will populate the closing costs details in the Paid by Others column on page 2 of the Closing Disclosure.

Closing Disclosure, page 2