2308 Completing the Aggregate Adjustment on the Closing Disclosure

To enter and calculate the Aggregate Adjustment:

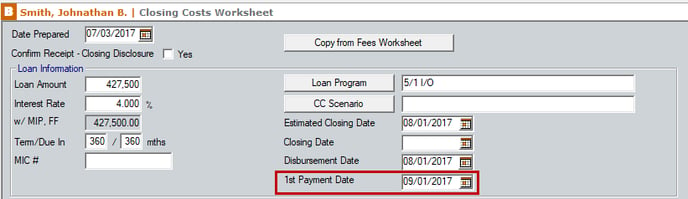

1. Go to the Closing Costs Worksheet.

You can also calculate the Aggregate Adjustment on the Fees Worksheet, but it will not populate the Loan Estimate.

2. Enter the 1st Payment Date on the upper right of the screen.

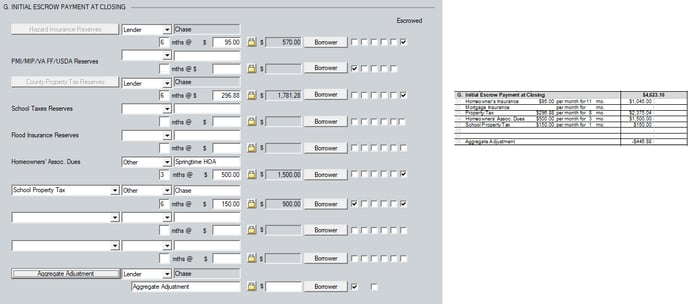

4. Select the Escrowed check box for each item to be escrowed and click the Aggregate Adjustment button.

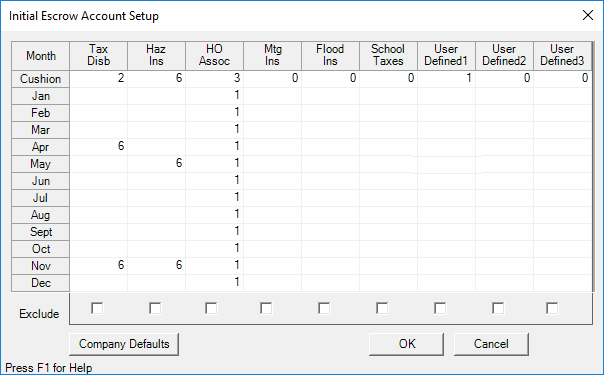

The screen might already display default values if they were set up in Utilities > Company Defaults, but you can adjust the values as needed for a particular escrow item.

6. Enter the number of months that are to be paid in the months when they are due for each item that is escrowed.

For example:

Six (6) months of taxes are due in April and another six months of taxes are due in December, or 12 months of hazard insurance is due in October. To exclude any column from the aggregate accounting, select the Exclude check box at the bottom of the appropriate column.

1. Click OK.The amount to be collected at closing will automatically calculate.

2. Click OK to calculate the aggregate adjustment and populate the Closing Costs Worksheet.The aggregate adjustment populates in Section G on page 2 of the Closing Disclosure.