The Fees Worksheet has been revised to add the Prepaids and Closing Costs, so it now matches the Lender Loan Information - Pg. 2, field F. Borrower Closing Costs and will print the Total Closing Costs.

Note: This article is for working through and updating fields for the Fees Worksheet to flow with the Lender Loan Information – Page 2.

Seller/Lender Credits

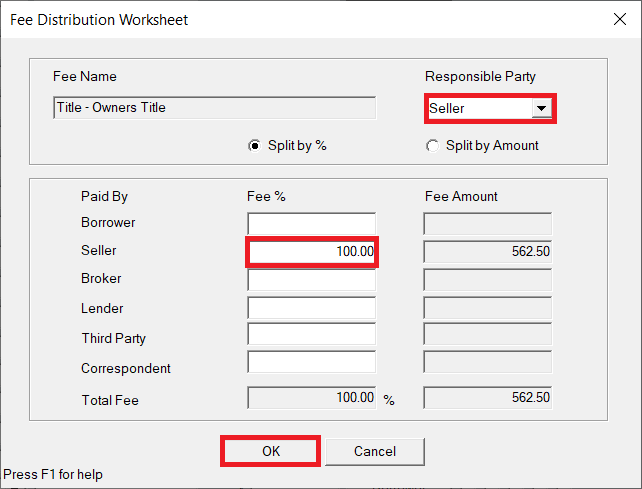

1. Review the individual fees listed and update any that may be Seller paid.

a. Click the button under the Paid by column to open the Fee Distribution Worksheet.

![]()

b. Use the Responsible Party dropdown to select Seller.

c. Change the Fee % to the correlating Paid By party.

d. Click OK.

e. The Fees Worksheet will read as a seller cost instead of a borrower paid fee.

![]()

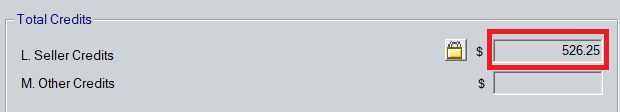

Note: Any updated fees will transfer to the Lender Loan Information - Page 2 screen under the Total Credits section, line L. Seller Credits.

2. Click the Payoffs & Adjustments button at the bottom of the screen.

![]()

3. Enter any additional Credits in the appropriate fields on this screen.

IMPORTANT: You only need to add Lump Sum Credits on the Payoff & Adjustments screen - this comes from your purchase contract or if you intend to cover any additional costs for the borrower not marked on the Fees Worksheet so your Credit Totals will populate on the Lender Loan Information - Page 2.

Payoff Summary

Payoff debts such as mortgage and other debts will be grouped together on the Fees Worksheet unless all information pertaining to said debt is entered correctly in the appropriate section for the liability type.

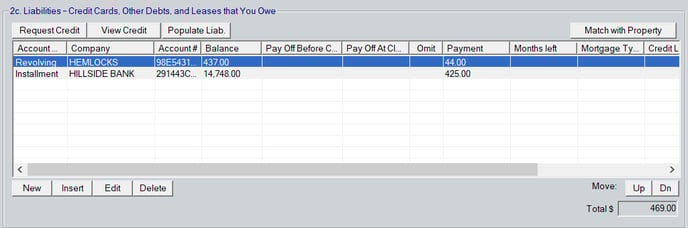

1. Review the Liabilities listed in section 2c. Liabilities - Credit Cards, Other Debts, and Leases that You Owe.

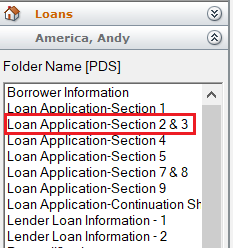

a. Open Loan Application - Section 2 & 3 from the left navigation panel in your file.

b. Scroll down to section 2c. Liabilities - Credit Cards, Other Debts, and Leases that You Owe.

c. Assure that any liabilities being paid off have their account information fully filled in.

Note: The most often missed is the Mortgage Type dropdown.

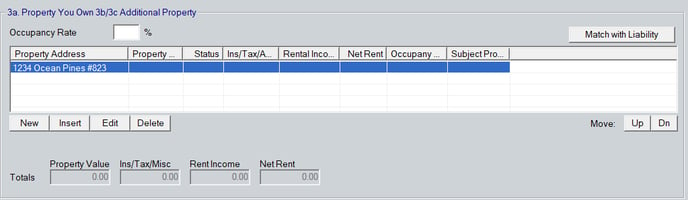

2. Review the Real Estate Owned entries for the file being refinanced entered in the table 3a. Property you own 3b/3c Additional Property.

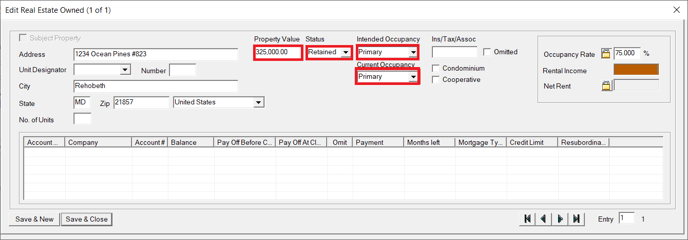

a. Select and open a REO that has a correlation liability.

b. Complete any blank fields.

Note: The most missed are the Intended Occupancy and Current Occupancy dropdown fields.

c. Click the Save & Close button.

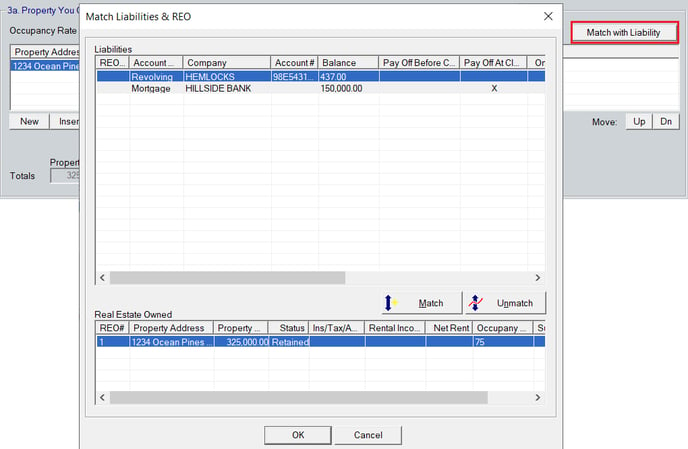

d. Use the Match with Liability button to open the Match Liabilities & REO window.

e. Select the appropriate Liability and Real Estate Owned list item from each table.

f. Click the Match button between the tables.

g. Click OK.

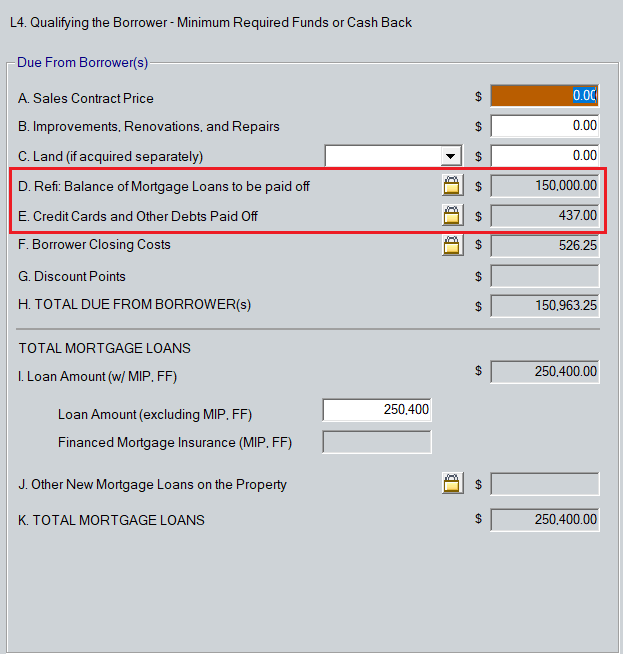

Debts are now shown as split between Mortgage and Other Debts to be Paid Off on the Lender Loan Information - Page 2 under section L4. Qualifying the Borrower - Minimum Required Funds or Cash Back lines D. Refi: Balance of Mortgage Loans to be paid off and E. Credit Cards and Other Debts Paid Off.

Earnest Money/Cash Deposit

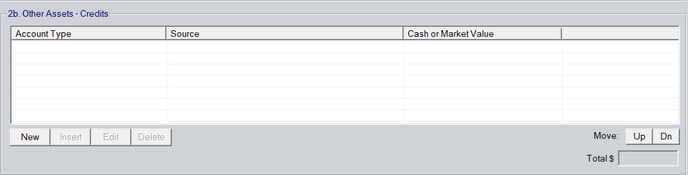

Any Earnest Money and/or Cash Deposits to be entered in the file need to be placed in the Loan Application - Section 2 & 3 table 2b. Other Assets - Credits to properly carry to the Lender Loan Information - Page 2.

1. Select Loan Application - Section 2 & 3 from the left navigation panel from within the file.

2. Scroll to table 2b. Other Assets - Credits.

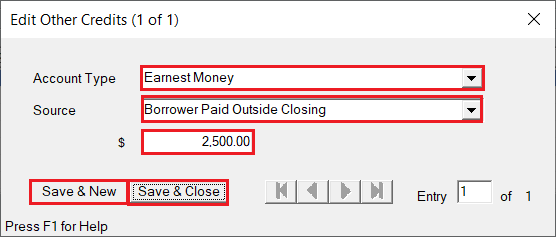

3. Click the New button to open the Edit Other Credits window.

4. Use the Account Type dropdown to make your selection.

5. Select the Source of the funds.

6. Enter the amount in the $ field.

7. Click Save & New to add more items or Save & Close when finished.

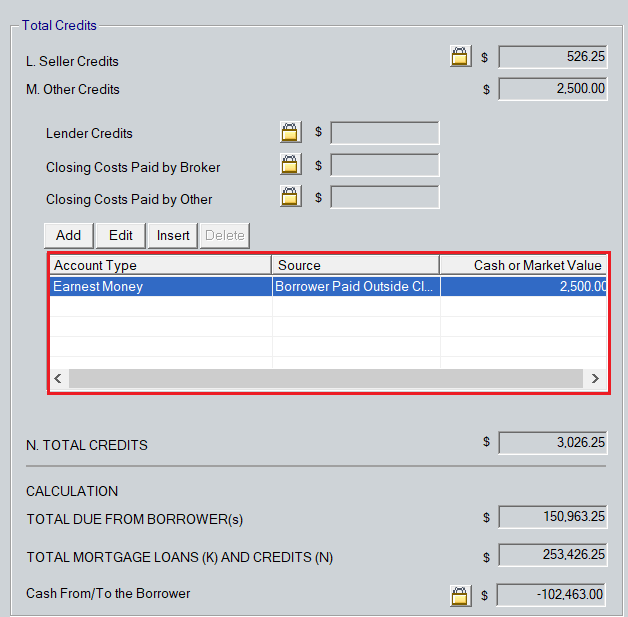

The entry(s) will now populate on Lender Loan Information - Page 2 under the Total Credits section.

IMPORTANT: If you use this table to add Credits, the figures will populate on the Fees Worksheet only and will not carry over the Loan Estimate.