2509 Completing the Good Faith Estimate

The printed Good Faith Estimate is comprised of three pages and can be accessed from within a loan file by selecting Forms > Good Faith Estimate, from the menu bar. If the loan is a new construction loan, and one of the construction options is selected in the Purpose of Loan section on the Borrower Information screen, a fourth page, New Construction Statement, is automatically printed when you print the GFE.

You must fill in the Initial Fee Worksheet first, which will populate the Good Faith Estimate.

GFE Disclosures

- Disclosed Date is the date when the GFE was disclosed to the borrower.

- Re-disclosed Date is the date that the GFE was re-disclosed to the borrower.

- Disclosed Method is the method used to deliver the GFE to the borrower.

- Re-disclosed Method is the method use to deliver a re-disclosed GFE to the borrower.

Important Dates

- Date Prepared is the date when the GFE was prepared. It will print the current date, therefore the field is grey. However, you can un-grey the field by clicking Utilities from the menu bar, go to Company Defaults > GFE/TIL Disclosures and uncheck the Print current date on all disclosures checkbox.

- Interest Rate Available Through is the period in which the loan officer is honoring the interest rate.

- Estimate Available Through is the length of time that the GFE is valid for the borrower.

- Rate Lock Period is the amount of days before the rate lock expires.

- Days Before Settlement... must be a minimum of 10 days.

Summary of Loan

Click the Calculate button at the bottom of the GFE (2010) to populate the following fields: (These fields will populate based from the information entered on the Truth-In-Lending form)

- Can the interest rate rise? (Applies for an ARM loan)

- Even if payments are made on time, can the Loan Balance rise? (Applies for a Neg Am. loan)

- Even if payments are made on time, can the Monthly Principal, Interest, and MI rise? (Applies for an ARM loan)

Only check the boxes for any question that applies to the loan. Although a figure will be calculated for every field, it will not print unless the checkbox is checked.

Escrow Account Information

If the loan does not have an escrow account, Insert a check into the The Loan does not have an Escrow Account checkbox. If the loan does have an escrow account, leave the checkbox blank.

The monthly payment that displays in this section does not include taxes or insurance.

Summary of Settlement Charges - These fields automatically calculate from the Fees Worksheet.

A. Adusted Origination charges is the total Origination charge minus lender rebate.

B. All Other Settlement Services Charges is the total of all fees not including the origination charges.

Adjusted Origination Charges

1. Origination Charge is all origination charges from the Fees Worksheet

2. Credit or charge (points) for the specific interest rate chosen.

The Credit or charge for interest rate on this loan is included... - check this box when there is not a rebate nor a discount.

Borrower Receives a credit of... check this box when there is a lender rebate, which will apply a borrower credit.

Borrower pays a charge of... check this box when the borrower pays a discount, which will apply a borrower charge.

Charges for All Other Settlement Services

3. Required Services Selected by Mortgage Company - populates from the Fees Worksheet.

4. Title Services and Lender's Title Insurance - populates from the Fees Worksheet.

5. Owner's Title Insurance - populates from the Fees Worksheet.

6. Required Services That Borrower Can Shop For - populates from the Fees Worksheet and into the Service Provider List.

7. Government Recording Charges

8. Transfer Taxes

9. Initial Deposit in Escrow Account

10. Daily Interest Charges

11. Homeowner's Insurance

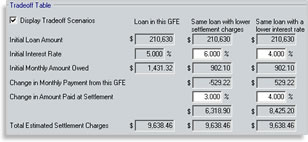

Tradeoff Table (Optional)

Insert a check into the Display Tradeoff Scenarios checkbox.

- The first scenario populates from fields on the subject loan.

- The second scenario provides an overview of the subject loan with lower settlement charges and a higher rate.

- The third scenario provides an overview of the subject loan with a lower rate and higher settlement charges.

Using the Shopping Cart (Optional)

The shopping cart is not available as a screen in Point. It is only available on the printed Good Faith Estimate (2010). This section can be used if you shop for rates and settlement charges from other originators. You must manually fill this section in on the printed form.