2518 Using the Anti-Steering Disclosure

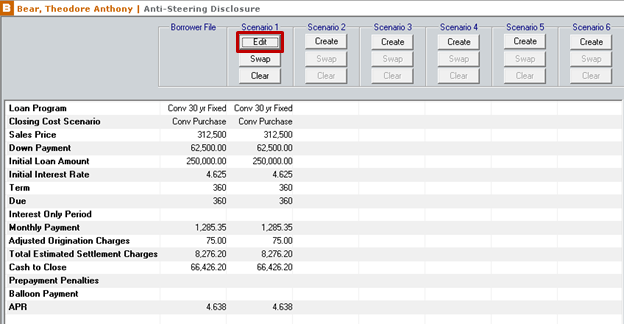

You can create up to six loan scenarios from the Anti-Steering Disclosure screen for comparison.

1. To access the Anti-Steering Disclosure, go to Forms > Anti-Steering Disclosure. The first column on the Anti-Steering Disclosure contains the current loan information in the borrower file. The remaining scenario columns are used to create and compare alternate loan scenarios without changing the actual loan data.2. Click Create in any of the Scenario columns to a new loan scenario. The Scenario column is populated with the current loan data and the Create button changes to Edit.

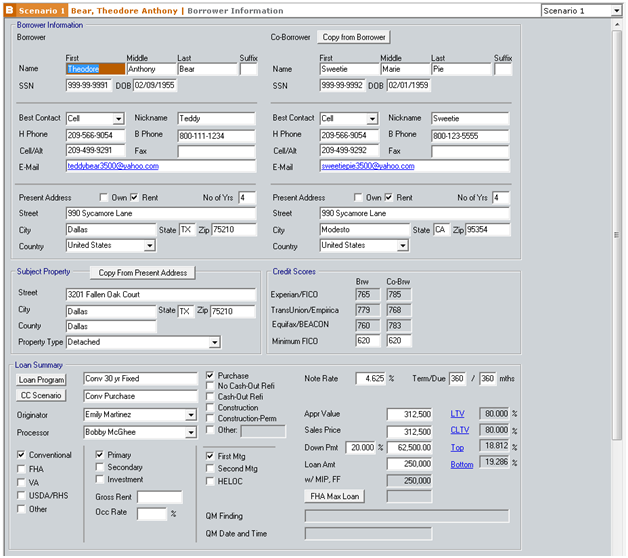

4. The Borrower Information screen for that scenario is displayed.

5. Make any changes for this loan scenario. You can access any screen and form to make the required adjustments to the loan criteria, such as adjusting the down payment, interest rate, or closing costs.

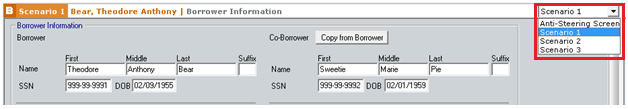

Use the dropdown list on the right to switch between loan scenario files.

6. When you are finished entering the scenario criteria, select Anti-Steering Screen from the dropdown list to return to the primary loan file.

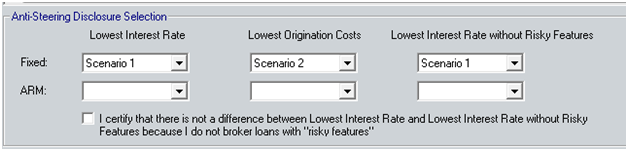

7. Complete the Anti-Steering Disclosure Selection section to specify which scenarios will print on the disclosure.

- Use the Fixed dropdown lists to show fixed rate scenarios. Select the scenarios withe the Lowest Interest Rate, the Lowest Origination Costs, and the Lowest Interest Rate without RIsky Features.

- Use the ARM dropdown lists to show adjustable rate scenarios. Select the scenario with the Lowest Interest Rate, the Lowest Origination Costs, and the Lowest Interest Rate without Risky Features.

8. Select the checkbox to indicate that you do not broker loans with risky features, if applicable.

![]()

9. When the Swap button is enabled, you can use it to replace your loan data with the data in the associated scenario.

Two Anti-Steering Disclosure print forms are available. One for fixed rate loans and one for adjustable rate mortgage (ARM) loans. Be sure to select the appropriate disclosure for your loan.

Note: Separate disclosures, loan applications, and loan data are generated for each loan scenario created on the Anti-Steering Disclosure screen. Be sure to switch back to the primary application before printing your disclosures by using the dropdown list at the top of the screen.