2521 Completing the Lender Loan Information screens

The Lender Loan Information screens collect information relation to the loan, such as refinance type, construction loan information, title, mortgage type and loan features, along with loan terms and proposed monthly payments.

1. Open a Point file.

2. Navigate to Lender Loan Information - 1 either from your left navigation panel or using the Forms menu in your top toolbar.

3. Review and complete section L1. Property and Loan Information as required for this loan file and type.

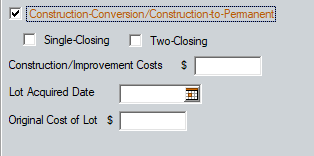

Note: If completing a construction loan file, checking the Construction-Conversion/Construction-to-Permanent box will open additional checkboxes and fields that pertain to that loan type.

Note: The Lender Case No. and Agency Case No. fields will populate based off what is entered in those same fields on pg.1/section 1 of the loan application.

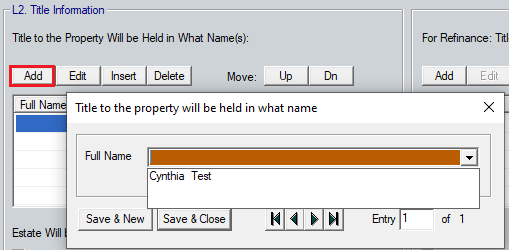

4. Complete section L2. Title Information.a. Click the Add button and use the dropdown to select the borrowers Full Name to be listed on the title.

b. Select New & Save to add additional names or Save & Close to exit the window.

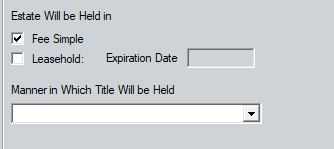

c. Use the checkboxes and available dropdown to complete the Estate Will be Held in and Manner in Which Title Will be Held options.

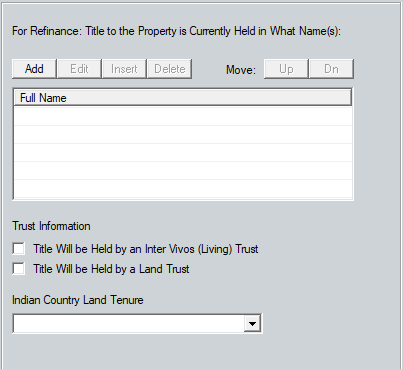

d. For a refinance, follow steps a. through c. to complete the For Refinance: Title to the Property is Currently Held in What Name(s) table.

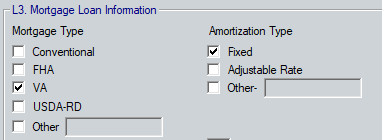

5. Complete section L3. Mortgage Loan Information

a. The Mortgage Type and Amortization Type checkboxes will be marked based off selections on the Borrower Information screen. Review and modify as necessary.

b. Complete the Interest Period Prior to First Adjustment and Subsequent Adjustment Period fields as applicable.

![]()

i. The numbers that will populate these fields come from the Truth-In-Lending screen.d. The Terms of Loan and Mortgage Lien Type columns will populate from the Borrower Information screen.

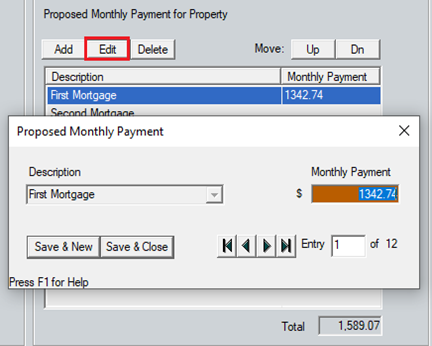

Data in the Proposed Monthly Payment for Property table will populate based on information in the Fees Worksheet or the Closing Costs Worksheet. If the Freeze Fees checkbox is marked, the table will populate from the Closing Costs Worksheet, if it is not marked then the table will populate from the Fees Worksheet.

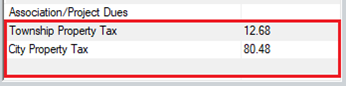

The first 3 rows beneath the Association/Project Dues row are reserved for and synch with the last 3 user defined fields on the Fees Worksheet/Closing Costs Worksheet. Any rows added using the Add button will appear directly beneath the 3 reserved rows.

e. Use the Edit button to modify the Monthly Payment for any of the existing rows.

i. Use the arrow buttons to cycle through the existing line items for easy editing.f. Click the Save & Close button when finished.g. Use the Add button to add additional items to the table.6. Click the Page 2 button at the bottom of the screen.

This screen collects information regarding the borrower's cash to close, such as debt to be paid off, closing costs, credits and other charges.

Multiple fields in section L4. Qualifying the Borrower - Minimum Required Funds or Cash Back will populate based off information entered on the Loan Application - Section 2 & 3, Fees Worksheet, Closing Costs Worksheet, and Loan Application - Section 4 screens.

- D. Refi: Balance of Mortgage Loans to be paid off populates when the loan is a refinance and there is a liability in table 2c. Liabilities marked as "paid off at closing" and is matched with a property in table 3a. Property you own from Loan Application - Section 2 & 3.

- E. Credit Cards and Other Debts Paid Off populates from liabilities listed in table 2c. Liabilities that are marked "paid off at closing."

- F. Borrower Closing Costs populates based off information from the Fees Worksheet and reflect the Total Estimated Settlement Charges Paid at Closing.

- G. Discount Points will reflect the total amount of fees paid by all parties from the Fees Worksheet or the Closing Disclosure.

- If the Freeze Fees checkbox is selected, this data will pull from the Closing Costs Worksheet, if it is not selected it will pull from the Fees Worksheet.

- If the Freeze Fees checkbox is selected, this data will pull from the Closing Costs Worksheet, if it is not selected it will pull from the Fees Worksheet.

- H. TOTAL DUE FROM BORROWER(S) will total lines A. through G.

- I. Loan Amount (w/ MIP, FF) lists the amount of the loan being requested.

- J. Other New Mortgage Loans on the Property populates from table 4b. Other New Mortgage Loans... from Loan Application - Section 4.

- K. TOTAL MORTGAGE LOANS totals lines I. and J.

- L. Seller Credits populates from either the Fees Worksheet or the Closing Costs Worksheet depending on if the Freeze Fees checkbox is marked.

- M. Other Credits is equal to the sum of Lender Credits + Closing Costs paid by Broker + Closing Costs paid by Other.

- The CALCULATION section at the bottom of L4. will total the amounts Due From Borrower(s), Mortgage Loans (K) and Credits (N) and show the total for Cash From/To the Borrower.

Section L5. Homeownership Education and Housing Counseling is for entering information to show which borrower(s) have completed the HOEPA education and/or counseling requirements.