2629 Including Lender-Paid Compensation on Lender Loan Information – Page 2

Any Lender-Paid Compensation that is to be included on Lender Loan Information - Page 2 must be indicated on the Fees Worksheet or the Closing Costs Worksheet as appropriate to calculate and populate the associate field(s).

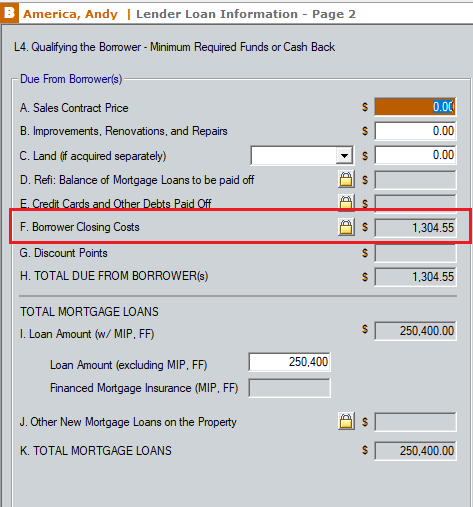

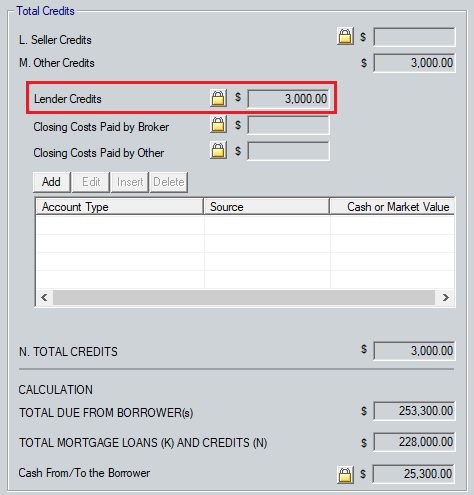

Any Lender-Paid Compensation from the Fees Worksheet or the Closing Costs Worksheet will automatically be calculated in the closing costs on the Lender Loan Information - Page 2. When entered on the Fees Worksheet they are included in line F. Borrower Closing Costs, whereas when added on the Closing Costs Worksheet they will be calculated and added into any Lender Credits for your closing 1003 under the Total Credits section.

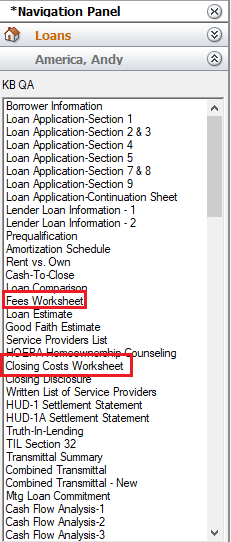

1. Open the file in Point.

2. Navigate to the form being used to indicate the inclusion of the Lender-Paid Compensation.

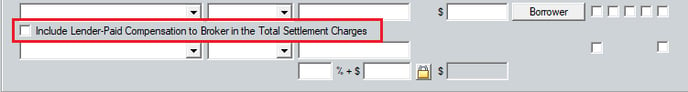

3. Scroll to the bottom of section A. Origination Charges.

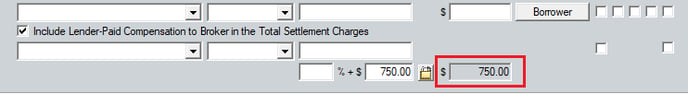

4. Mark the Include Lender-Paid Compensation to Broker in the Total Settlement Charges checkbox.

5. Complete the below Fee and Paid To dropdown along with the Company Name field as applicable.

6. Enter a % and/or $ amount to be added to the Amount Total.

7. The Lender-Paid Compensation from these fields will carry and add to the totals in the corresponding field of the Lender Loan Information - Page 2 based on the Worksheet used:

- Making the selection on the Fees Worksheet will calculate the Lender-Paid Compensation to reflect under the Due from Borrower(s) section for the Lender Loan Information - Page 2, line F. Borrower Closing Costs.

- Marking the selection on the Closing Costs Worksheet will calculate the Lender-Paid Compensation to reflect as Lender Credits under the Total Credits section of Lender Loan Information - Page 2.

Note: You must have the Freeze fees on the Loan Estimate with the disclosed amount checkbox on the Fees Worksheet marked for the calculations to carry over to the Lender Credits field.