2408 Filling in the VA Loan Comparison screen

The VA Loan Comparison form is provided for borrowers refinancing VA Loans. This article is divided into sections for filling in the fields on the VA Loan Comparison screen.

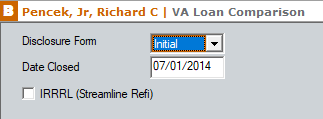

The Disclosure Form dropdown:

The Closing Costs for your file will calculate based off your selection from this dropdown. If Initial is chosen, the calculations will be based off the Fees Worksheet whereas if Final is selected, the calculations will be based off the Closing Costs Worksheet. The selections made can also determine which VA form will print.

The IRRRL (Streamline Refi) checkbox:

This checkbox is used to prompt Point to print the IRRRL Comparison Statement, regardless of which Disclosure Form is being used.

For more information on the print forms, refer to knowledge base article 1606 Determining which VA Loan Comparison form will print.

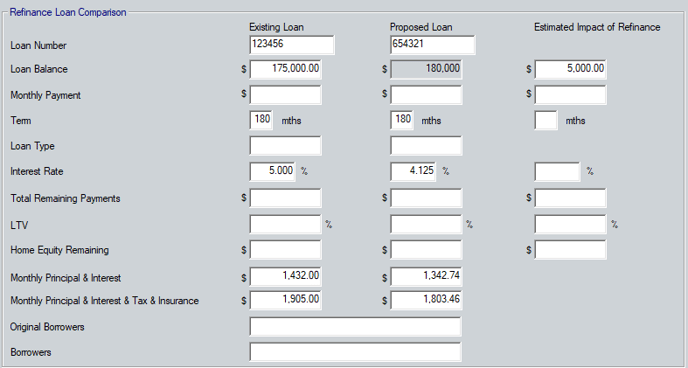

Refinance Loan Comparison

The Refinance Loan Comparison section is used to calculate the difference in monthly costs from the borrower's existing loan vs the new proposed refinance loan and to provide an estimate on the impact of the refinance to the borrower(s).

In the Existing Loan column, verify any populated data and complete any remaining fields that pertain to this file for the borrower's pre-existing mortgage loan.

The Proposed Loan column will auto populate some fields from the loan term information that you entered on the Borrower Information screen, but many fields in this column are manual entry. You can enter the new proposed loan terms here if you haven't entered them already, along with the estimated differences from the refinance.

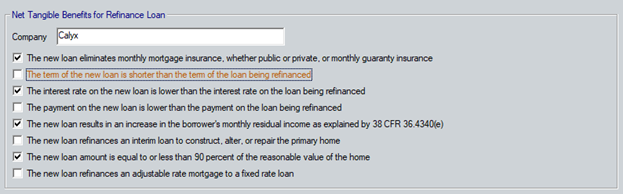

Net Tangible Benefits for Refinance Loan

In the Company field enter the company who closed the borrowers pre-existing loan. Use the checkboxes in this section to mark any and all net tangible benefits that apply to the proposed refinance.

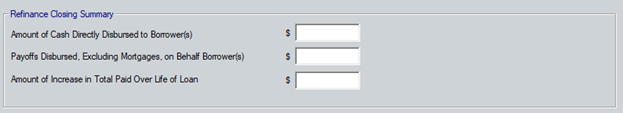

Refinance Closing Summary

This section outlines the amounts disbursed directly to the borrower(s), payoffs made on behalf of the borrower(s), and the amount of increase in the total that will be paid over the life of the loan. Complete the available fields as pertains to the loan.

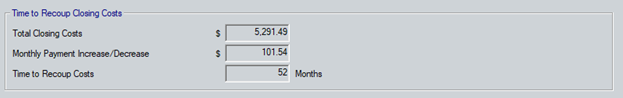

Time to Recoup Closing Costs

The Total Closing Costs field will populate based on which option has been selected from the Disclosure Form dropdown at the top of the screen: when Initial is selected, the total will populate from the fees on the Fees Worksheet, whereas Final pulls from the Closing Costs Worksheet, including all fees that are not checked as POC.

The Monthly Payment Increase/Decrease field will populate from the difference between the monthly principal, interest, taxes and insurance of the Existing Loan column vs. the Proposed Loan column.

The Time to Recoup Costs indicates how long it would take to recoup all closing costs. The calculation is Total Closing Costs divided by the Monthly Payment Increase/Decrease.

If the monthly payment in the Proposed Loan column is higher than the existing loan the Time to Recoup Costs will not calculate since it is not required in an instance where the new monthly payment for the proposed refinance is higher than the existing loan.

Note: If the Time to Recoup Costs result is not a whole number, Point will round the months up to the next whole number (wx. 21.2 = 22).

Lender Certification (Check if Applicable)

If the monthly payment (PITI) increases by 20 percent or more, the lender must include a certification that the veteran qualifies for the new monthly payment which exceeds the previous payment by 20 percent or more.

Check the box if the new proposed monthly payment exceeds 20% of the borrower's existing monthly payment.